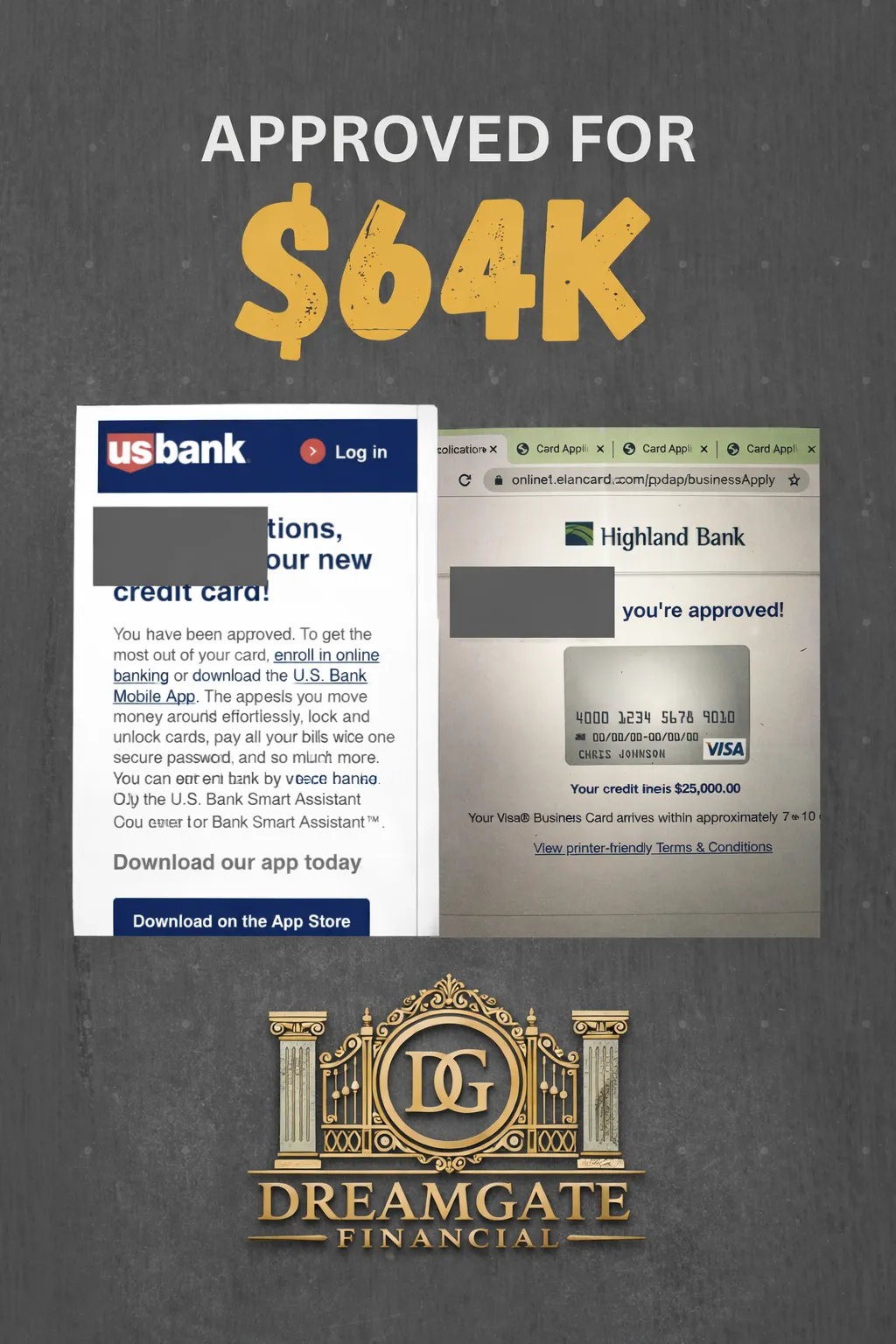

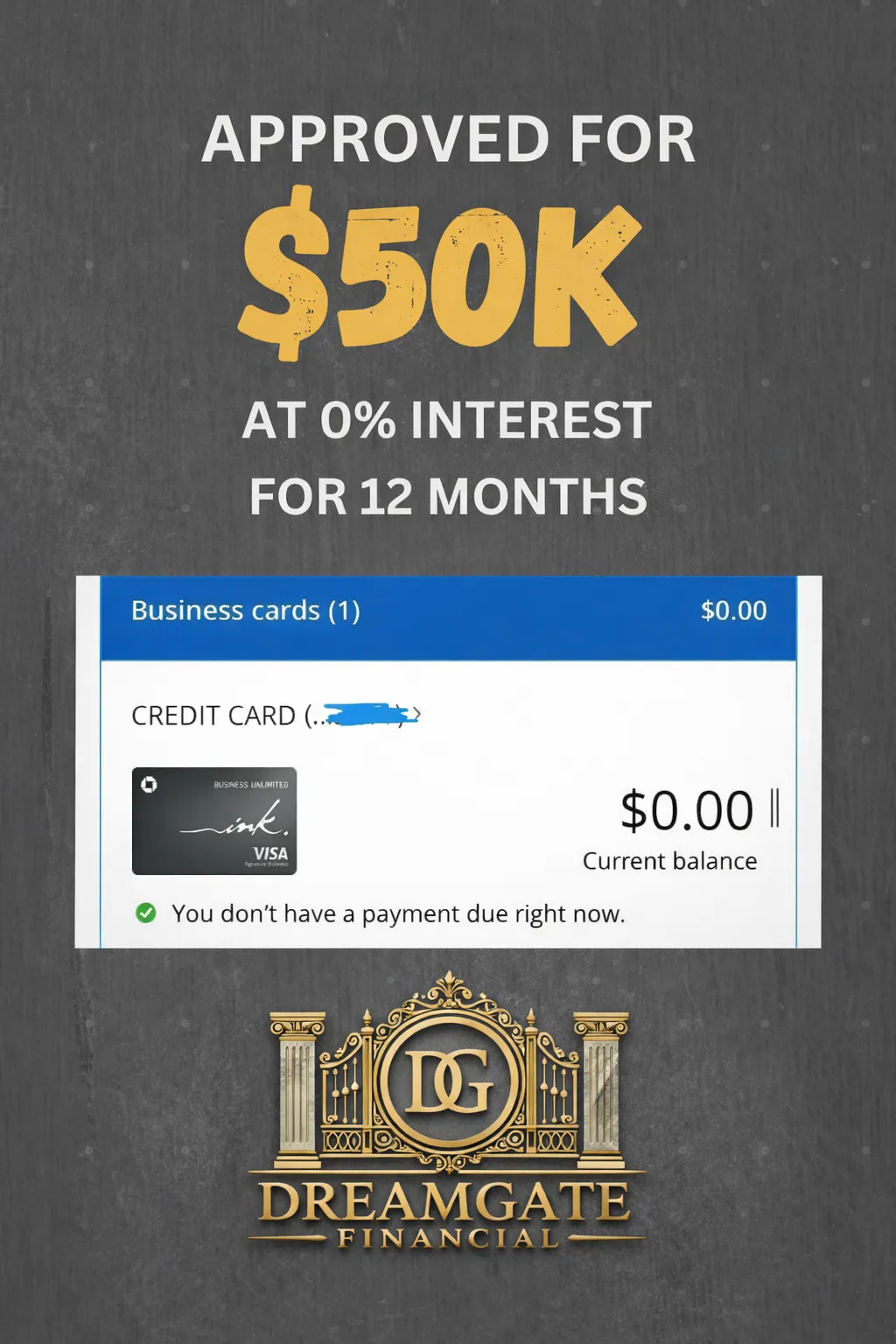

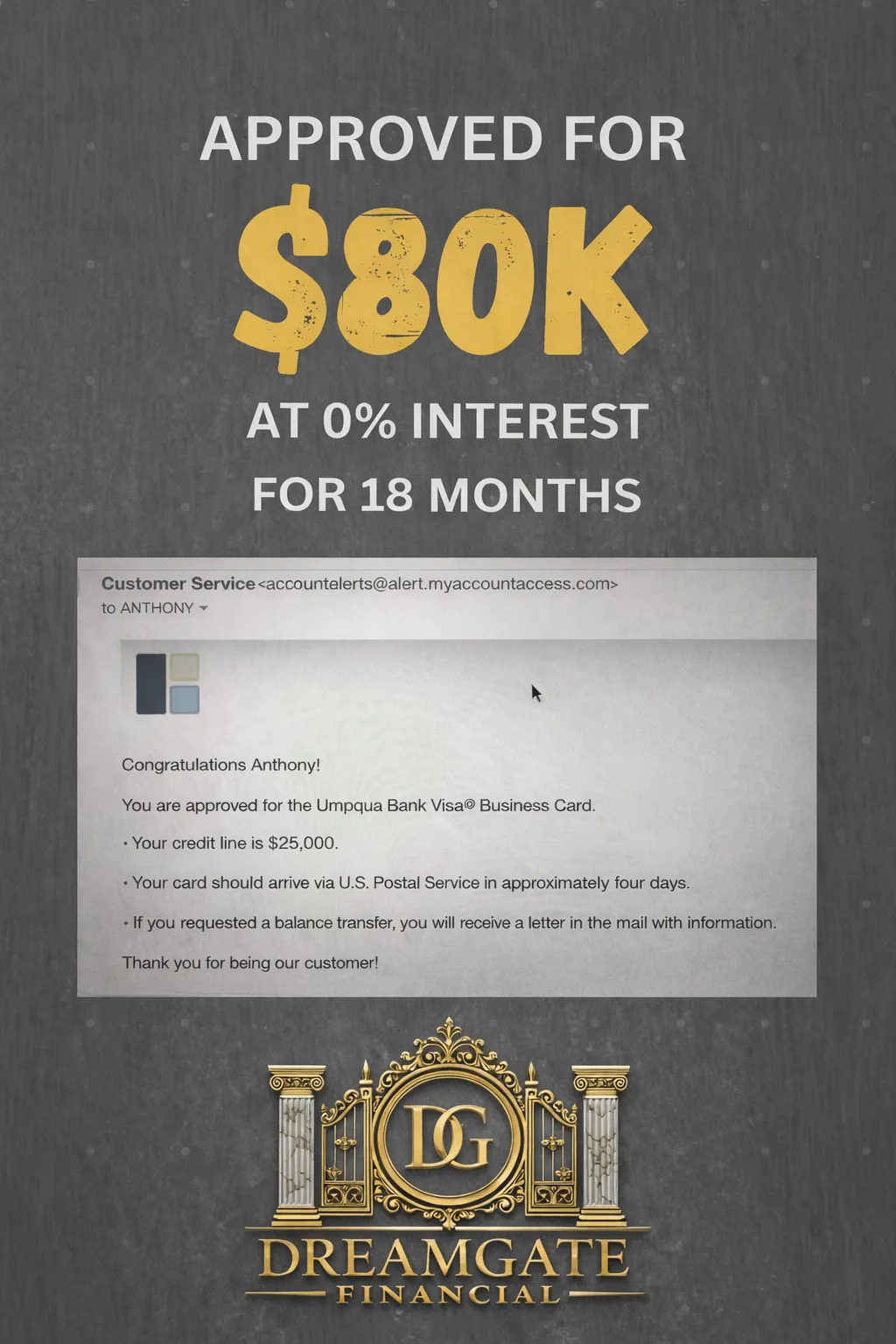

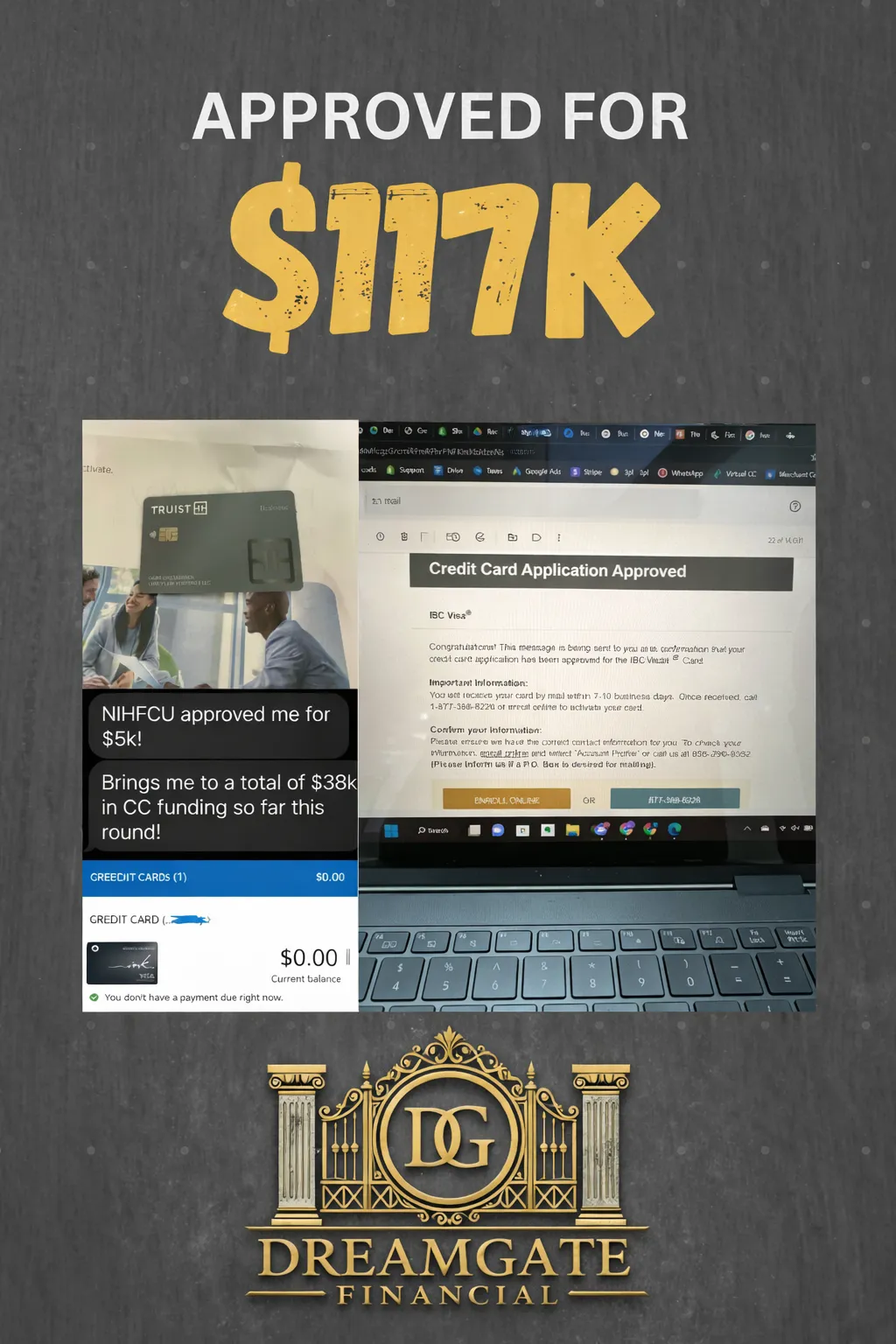

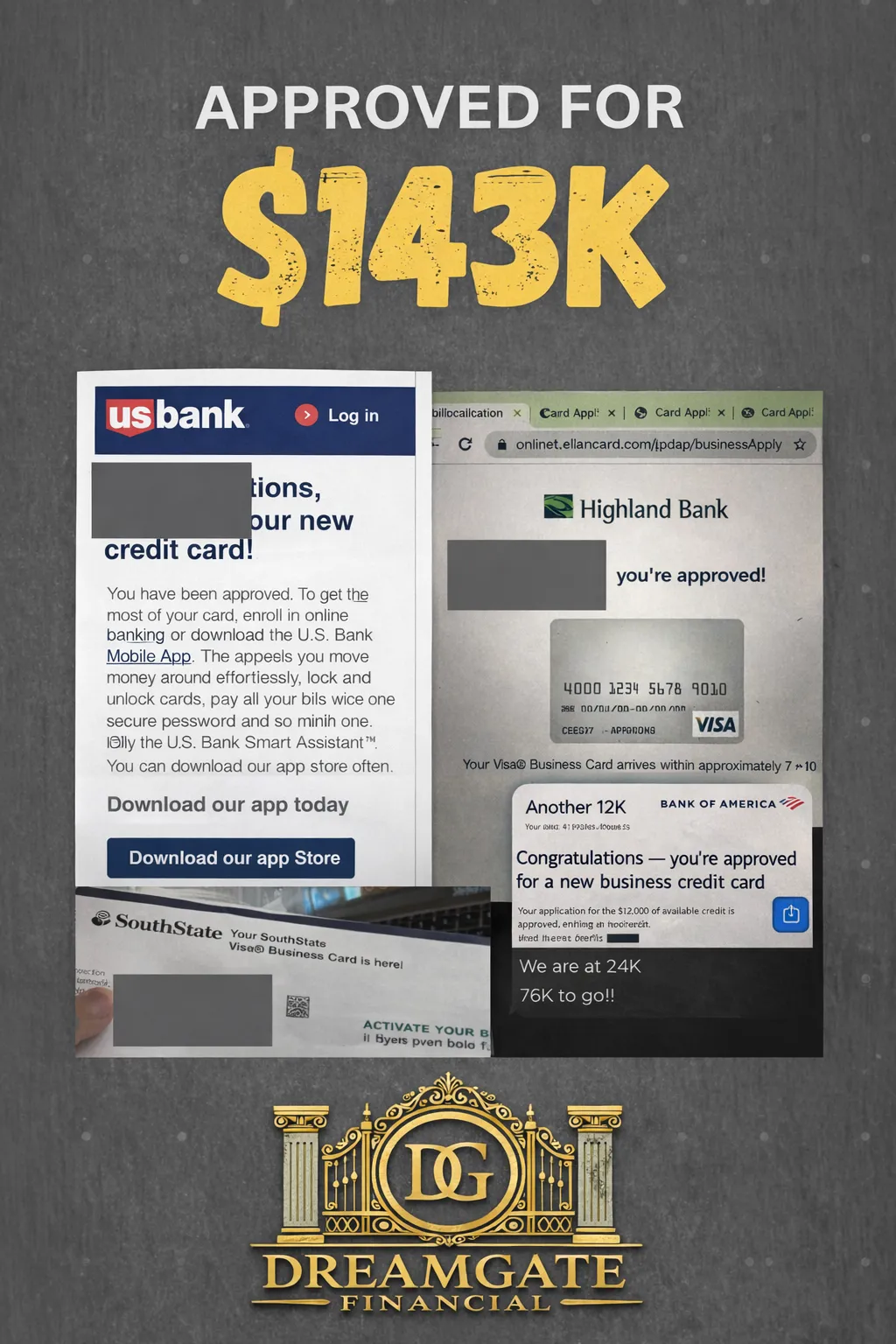

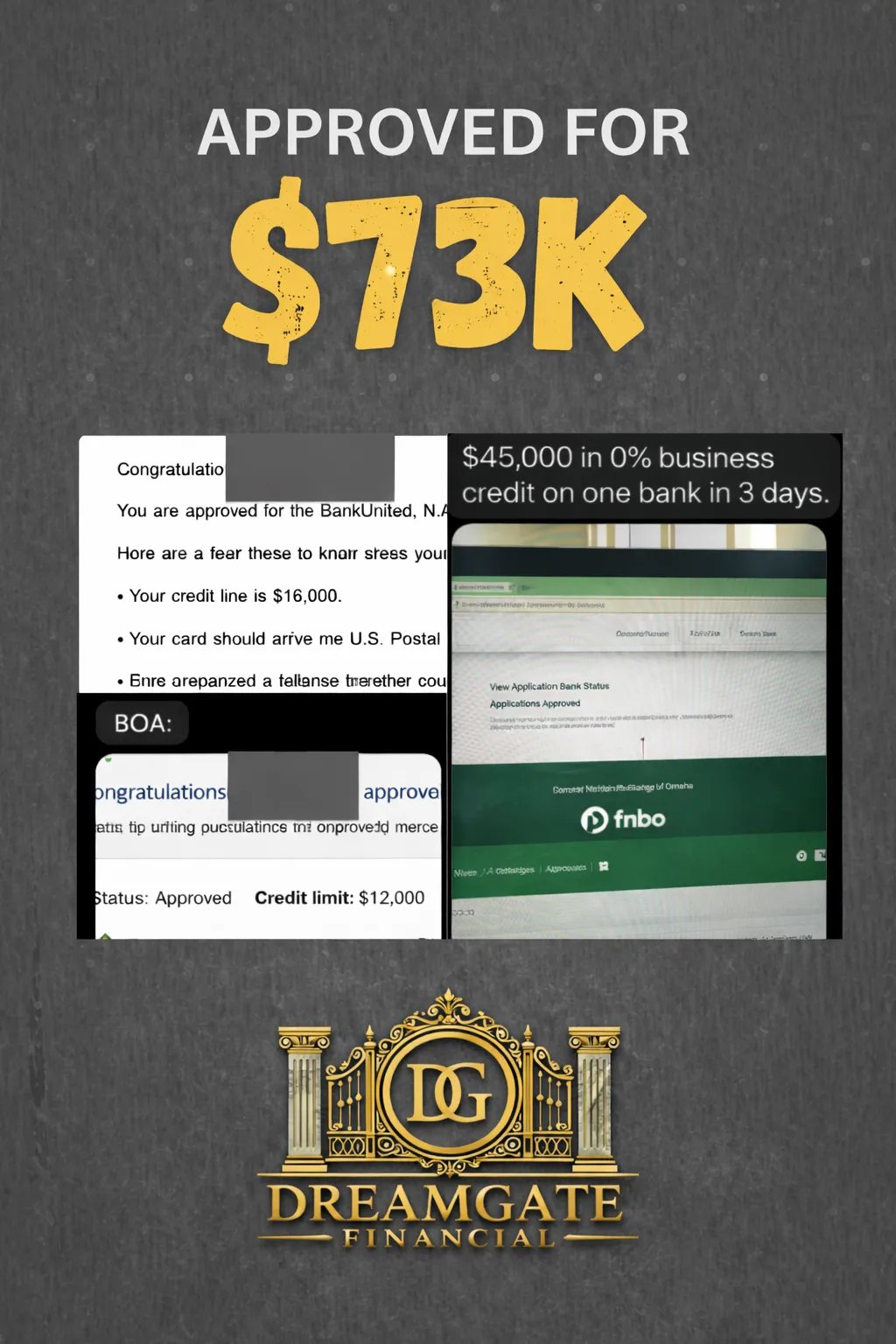

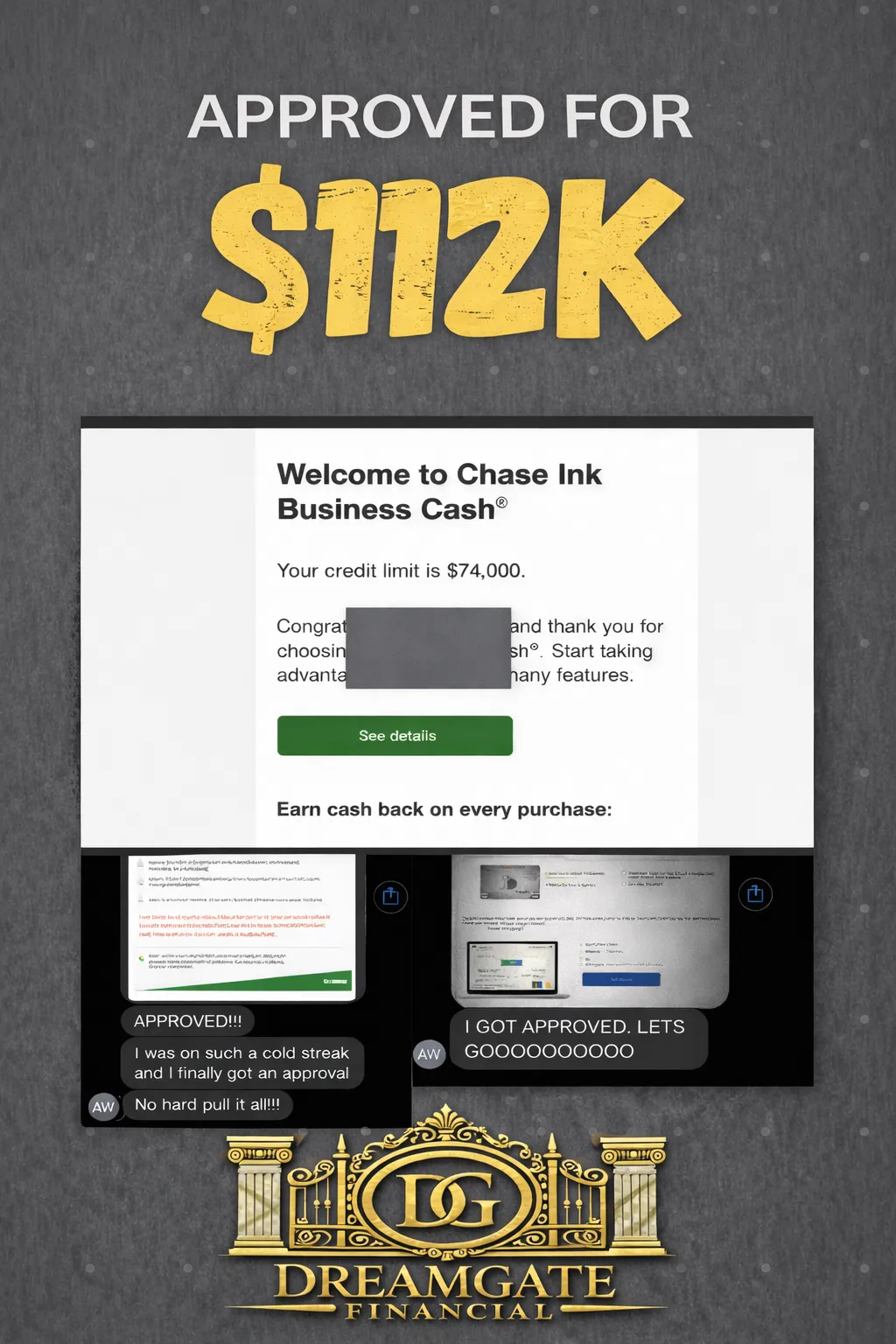

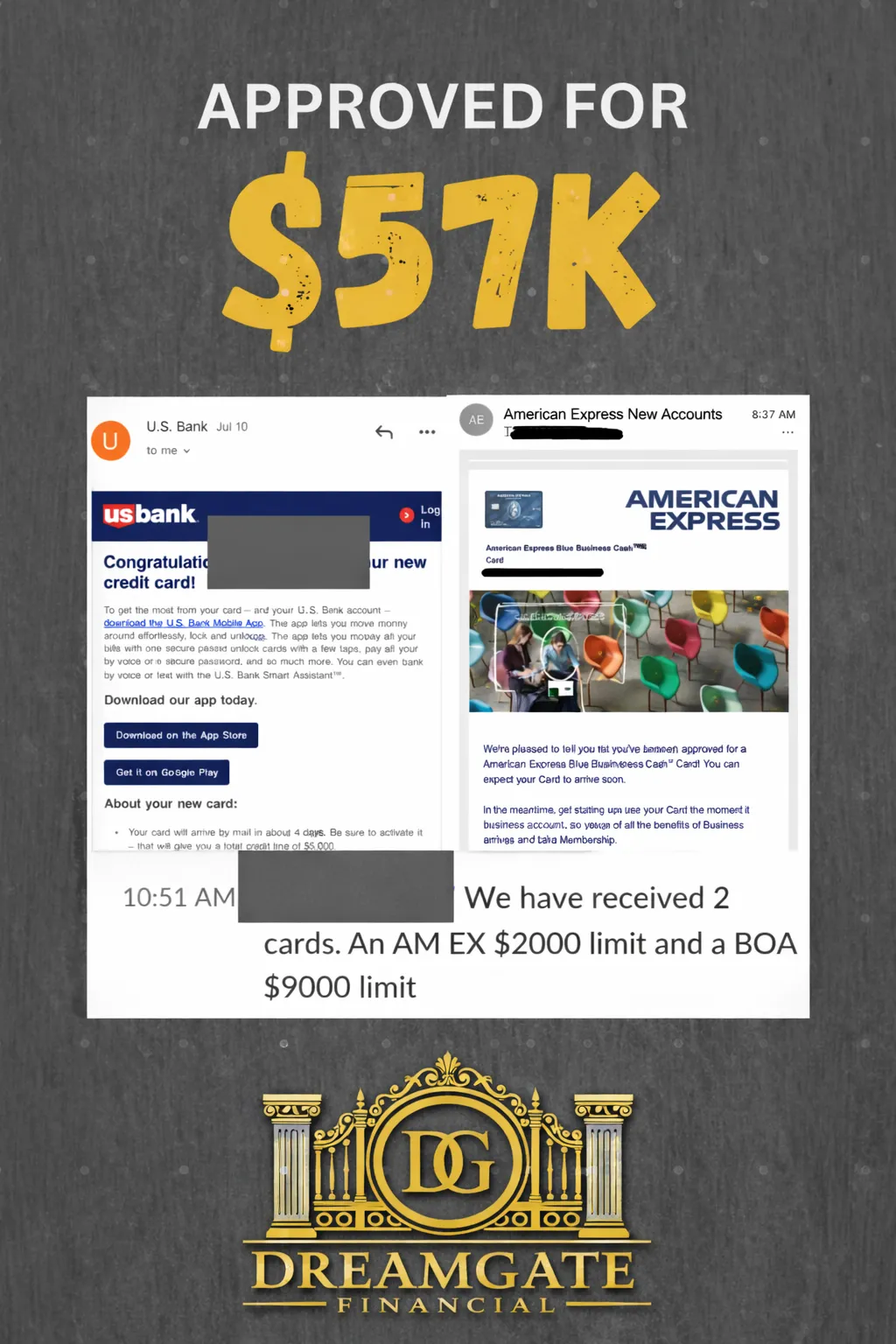

We Help You Qualify For Up To $250k Of Business Funding

Learn How To Qualify Without Hurting Your Credit

Our Services

Financing Solutions That

Power Your Growth

Whether you need traditional loans or innovative credit solutions, we have the expertise to match you with the right funding.

0% Interest Funding & Personal Loans

Leverage 0% introductory APR funding to grow your business without paying interest for up to 21 months.

0% APR for 12-21 months

Personal loans available

No collateral required

Fast approval process

Business Term Loans & Lines of Credit

Access flexible term loans and revolving credit lines tailored to your business cash flow needs.

Term Loans up to $5M

Flexible credit lines

Competitive interest rates

Customized repayment terms

Revenue-Based & Asset-Based Lending

Funding solutions based on your business revenue or existing assets—flexible options for growing companies.

Revenue-based financing

Asset-backed lending

Flexible qualifications

Quick funding turnaround

Equipment Financing & Invoice Factoring

Finance essential equipment or unlock cash tied up in unpaid invoices to keep your business moving.

Equipment loans & leases

Invoice factoring

Preserve working capital

Same-day funding available

Merchant Cash Advance & More

Get fast capital based on future sales—plus access to additional funding solutions for any business need.

Merchant cash advances

Fast approval process

Flexible repayment

Additional funding options

SBA Funding Options & More

We work with lenders who offer SBA funding options for your business. This option is best for established businesses or if you are looking to aquire an established business.

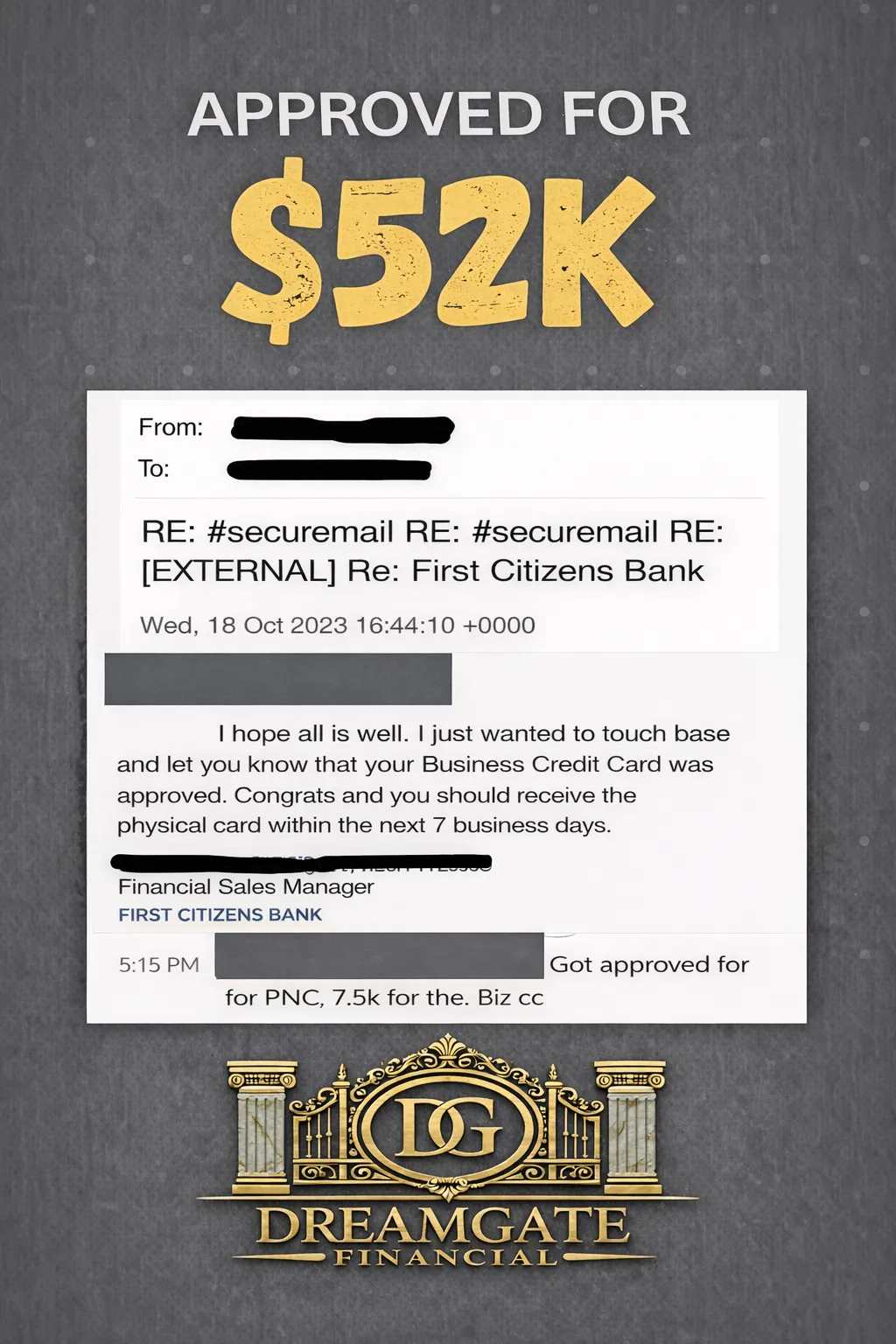

Imagine What This Funding Could Do For You...

Frequently Asked Questions

What does DreamGate help with?

We help clients access business funding through business credit education, funding strategy, lender matching, and application assistance utilizing our extensive knowledge in the funding space along with connections we have with certain istitutions. We are not a bank or lender.

Do you guarantee approvals or specific amounts?

No. Approval amounts depend on the client’s profile, credit, business structure, and lender underwriting. While we cannot guarantee results, we work to position clients as strongly as possible.

How much funding can I qualify for?

Funding amounts vary. Some clients qualify for funding immediately, while others may need preparation. Typical funding ranges can vary widely based on personal credit, business age, and financial profile. Each client is different and has a different credit profile. Some clients will need to go through credit repair which we also offer as a service. A extensive plan will be outlined for you on your call in which your specialist will go over the best plan to get you funding.

Do I need good personal credit?

We offer a wide array of funding options tailored to each client ranging from 0% funding through a method call credit card stacking, personal and business lines of credit, revenue based & asset based lending, equipment financing, merchant financing, sba financing, and more. Each client will vary based on certain criteria's. Overall a good personal credit score definitely helps and will allow you to get the best funding options possible however we do have funding options available that is not based on having a good personal credit score. Your funding specialist will cover all of this on your call and go over the best possible solutions for you based on your circumstances and goals.

How long does the funding process take?

Timelines vary. Some funding approvals can occur within days, while others may take several weeks depending on lender review and documentation. It depends on the clients circumstances, credit report, line of business, and other factors. Your funding specialist will be able to give you a timeline once you get on your call.

Will applying hurt my credit?

Once you sign on as a client we start off by going through our database and doing a series of soft pulls with different institutions to see what you qualify for. Once approved for certain products there will be inquiries that will be added on your personal credit in certain situations.

How much do your services cost?

Pricing depends on the level of assistance provided. All fees are disclosed upfront before any work begins.

What documents are required?

Common documents may include:

Personal identification

Business formation documents

EIN

Bank statements (if applicable)

Credit authorization

Requirements vary by lender.

Can I get funding with a new LLC?

Yes. New businesses may still qualify for funding, though options are more limited. Additional preparation may be required depending on your profile. Not to worry as we offer aged businesses called Shelf Corps so clients can still potentially obtain high funding. Your funding specialist will go over all these options more in detail with you to help you get the maximum funding possible.

Let's Get You Funded!

Copyright © 2026 Dream Gate Financial. All rights reserved.

Privacy Policy | Terms | Earnings Disclaimer | Cancellation & Refund Policy

NOT FACEBOOK™: This site is not a part of the Facebook™ website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook™ in any way. FACEBOOK™ is a trademark of FACEBOOK™, Inc.

* Earnings and income representations made by Dream Gate Financial, and their advertisers/sponsors are aspirational statements only of your earnings potential. These results are not typical and results will vary. The results on this page are OUR results and from years of testing.

We can in NO way guarantee you will get similar results.